This year’s record-breaking typhoon season in the Philippines – which saw six consecutive storm systems hit the country in under a month – was “supercharged” by climate change, according to a rapid attribution study.

The Philippines is one of the most vulnerable countries in the world to extreme weather. Between late October and mid November 2024, the country was hit by a barrage of storms, starting with severe Tropical Storm Trami on 22 October, and ending with Tropical Storm Man-Yi which made landfall on 16 November.

“Typhoon” is the term used to describe a tropical cyclone – a tropical storm with wind speeds of at least 33 metres per second – that forms in the north-west Pacific. (If a tropical cyclone forms in the Atlantic Ocean or north-eastern Pacific Ocean, it is called a hurricane.)

Even for a disaster-prone country, such rapid “clustering” of typhoons was “unprecedented”, one Filipino expert told a press briefing.

By the end of November 200,000 individuals were displaced across six regions – many of whom had been forced from their homes multiple times in just one month.

The World Weather Attribution (WWA) service finds that climate change has exacerbated the conditions that enabled these powerful storms to form in the Philippine Sea, such as warm seas and high humidity.

Of the six major storms that hit the Philippines between the end of October and middle of November this year, three made landfall as “major typhoons” with wind speeds above 50 metres per second (112 miles per hour). This is 25% more likely to happen in today’s climate than it would have been in a pre-industrial world without human-caused warming, the study finds.

The typhoons “highlight the challenges of adapting to back-to-back extreme weather events”, the study says. The authors add that “repeated storms have created a constant state of insecurity, worsening the region’s vulnerability and exposure”.

‘Unprecedented’ typhoon season

On 22 October 2024, severe Tropical Storm Trami made landfall on the Filipino island of Luzon – the country’s largest and populous island. The storm rapidly dumped one month’s worth of rain over parts of the island, with floods sweeping the country.

However, the residents were given little time to recover. Just days after Storm Trami subsided, the Philippines was hit by Super Typhoon Kong-Rey. More than nine million people were affected by the two storms and almost 300,000 displaced.

As the weeks progressed, the Philippines was hit by Typhoon Yinxing, Typhoon Toraji and Typhoon Usagi. Finally, Tropical Storm Man-Yi made landfall on 16 November, marking the end of the record-breaking month.

Afrhill Rances works at the Asia-Pacific regional office of the International Federation of Red Cross and Red Crescent Societies, and is an author on the WWA study. She told a press briefing that, even for a disaster-prone country, the rapid “clustering” of typhoons in 2024 was “unprecedented”.

Dr Claire Barnes – a research associate at Imperial College London’s Grantham Institute and an author on the study – added that in the Philippines, “in November we would expect to see only three named storms in the entire basin at any point, with only one of those reaching super typhoon status”. A super typhoon is defined as any typhoon with winds above 58 metres per second (130 miles per hour).

The back-to-back storms formed so rapidly that November saw four named storms forming in the Pacific basin simultaneously. Japan’s meteorological agency said this was the first time in seven years – and the first November in recorded history – where four named storms have formed in the Pacific at the same time.

Typhoon intensity

Typhoons are complex events, which can be intensified by climate change in many different ways, including their rainfall intensity, storm surge height and wind speed.

The authors of this study focus on a metric called “potential intensity”, which looks at temperature, humidity levels and sea level pressure over the Philippine Sea where the typhoons formed.

Ben Clarke, a study author from the Centre for Environmental Policy at Imperial College London, told the press briefing that potential intensity indicates the “theoretical maximum intensity for a tropical cyclone”. He explains that the metric is “based on the conditions in the atmosphere and the ocean which are crucial for cyclone development”.

The map below shows the average potential intensity of the Philippine Sea between September and November 2024, where red indicates high potential intensity and blue indicates low potential intensity.

The dotted lines show the tracks of different storms. The black square indicates the study area. Potential intensity is calculated as the potential wind speed of the typhoon in metres per second.

To put this year’s record-breaking typhoon season into its historical context, the authors analysed a time series of average potential intensity in the Philippine Sea, using an observational reanalysis dataset stretching back to the year 1940.

The study says:

“Our best estimate is that the observed potential intensity has become about 7 times more likely and the maximum intensity of a potential typhoon has increased by about 4 metres per second.”

The authors also carried out attribution analysis to assess whether the increase in potential intensity can be linked to human-caused climate change.

Attribution is a fast-growing field of climate science that aims to identify the “fingerprint” of climate change on extreme-weather events, such as heatwaves and droughts. To conduct attribution studies, scientists use models to compare the world as it is today to a “counterfactual” world without human-caused climate change.

The authors find that the potential intensity in the Philippine Sea in 2024 was 1.7 times higher than it would have been in a world without climate change. They add that the maximum potential intensity of a typhoon has increased by about 2 metres per second due to climate change.

(These findings are yet to be published in a peer-reviewed journal. However, the methods used in the analysis have been published in previous attribution studies.)

Landfall

Climate change is exacerbating the conditions needed for tropical cyclones to form. However, tropical cyclones are still fairly infrequent and there is a “short period of reliable observations” of tropical cyclones that make landfall, according to the study.

This can make it challenging for scientists to assess the impact of climate change on the frequency of tropical cyclones using traditional methods.

To address this problem, researchers from Imperial College London developed a “synthetic tropical cyclone dataset” called IRIS earlier this year. This dataset uses observations from 42 years of observed tropical cyclones to create a “10,000-year synthetic dataset of wind speed”.

The database includes millions of synthetic tropical cyclone tracks. Each track maps the wind speed of the tropical cyclone from its formation to its landfall, to describe how its power changes throughout its lifetime.

The team has already used this method to attribute the extreme winds of Typhoon Geami and Hurricane Beryl, which hit China and Jamaica, respectively, earlier this year.

Of the six major storms that affected the Philippines in the month-long period, three made landfall as “major typhoons”, according to the WWA. The authors define a major typhoon as a category three or above, indicating sustained wind speeds above 50 metres per second.

Using the IRIS dataset, the authors assessed how likely it is for three typhoons to make landfall in the Philippines in a single year under different warming levels. They find that in today’s climate – which has already warmed by 1.3C as a result of climate change – the Philippines could expect three major typhoons to make landfall in a single month roughly once every 15 years. This is 25% more frequent than in a world without climate change.

They add that if the planet warms to 2C above pre-industrial temperatures, “we expect at least three major typhoons hitting in a single year every 12 years”.

‘Supermarket of disasters’

The Philippines is one of the most vulnerable countries in the world to extreme weather events and natural disasters, and is already facing deadly impacts from climate change.

The country’s location in the Pacific ocean makes it highly vulnerable to typhoons, volcanoes and earthquakes. The WWA study adds that the country “is experiencing sea level rise more than three times faster than the global average”. And the Philippines is facing deadly heatwaves, which have been made more intense as a result of climate change.

Rances told the press briefing:

“In the Red Cross we call the Philippines a ‘supermarket of disasters’, because you name it – we have it.”

The Philippines is struck by more typhoons every year than almost any other country in the world. It has “gradually shifted its approach from reactive to proactive risk management with a significant focus on preparedness and resilience building”, according to the World Bank.

For example, warning and pre-emptive evacuation orders were sent out ahead of many of the typhoons this year. Schools, ports and airports were closed in many regions. And disaster response teams were mobilised.

However, the unrelenting barrage of typhoons this year overwhelmed many of the country’s disaster preparedness systems, exhausting supplies and overstretching emergency responders. It also left communities with little time between storms to recover and prepare.

The United Nations Office for the Coordination of Humanitarian Affairs estimates that, at the end of November 2024, more than 200,000 individuals were displaced across six regions, hundreds of fatalities and injuries had been reported and more than 250,000 homes had been damaged. The damage to livestock, agriculture and infrastructure was estimated to be around $47m at the end of November.

The Filipino government spent more than $17m on food and other aid for the hundreds of thousands of storm victims. It has also sought help from neighbouring countries, the US and the United Nations.

The consecutive typhoons “highlight the challenges of adapting to back-to-back extreme weather events”, the study says. It adds:

“With 13 million people impacted and some areas hit at least three times, repeated storms have created a constant state of insecurity, worsening the region’s vulnerability and exposure.”

The authors warn that “major investment is needed to help the Philippines adapt to extreme weather”.

The post Record-breaking Philippines typhoon season was ‘supercharged’ by climate change appeared first on Carbon Brief.

Record-breaking Philippines typhoon season was ‘supercharged’ by climate change

Greenhouse Gases

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

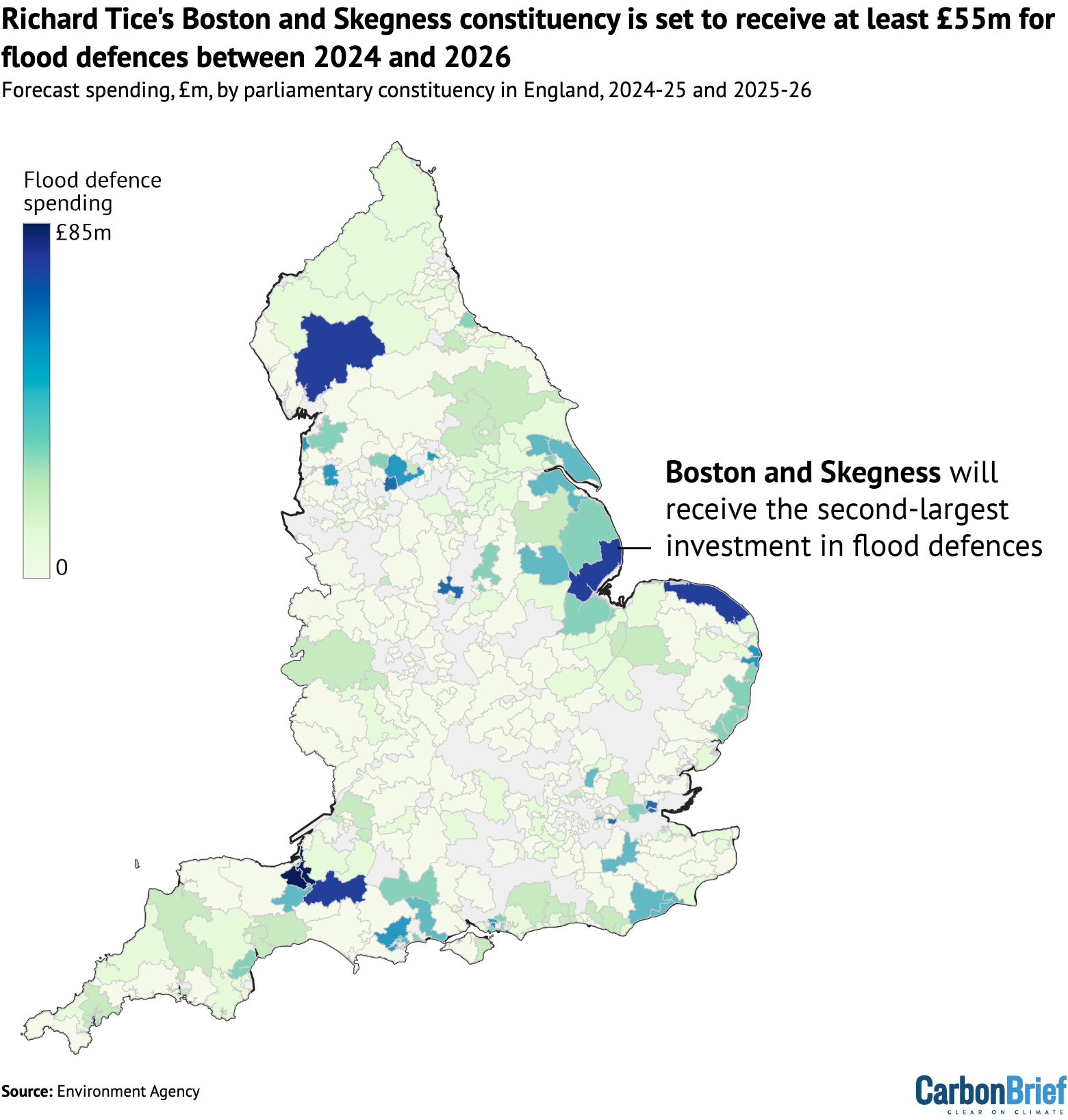

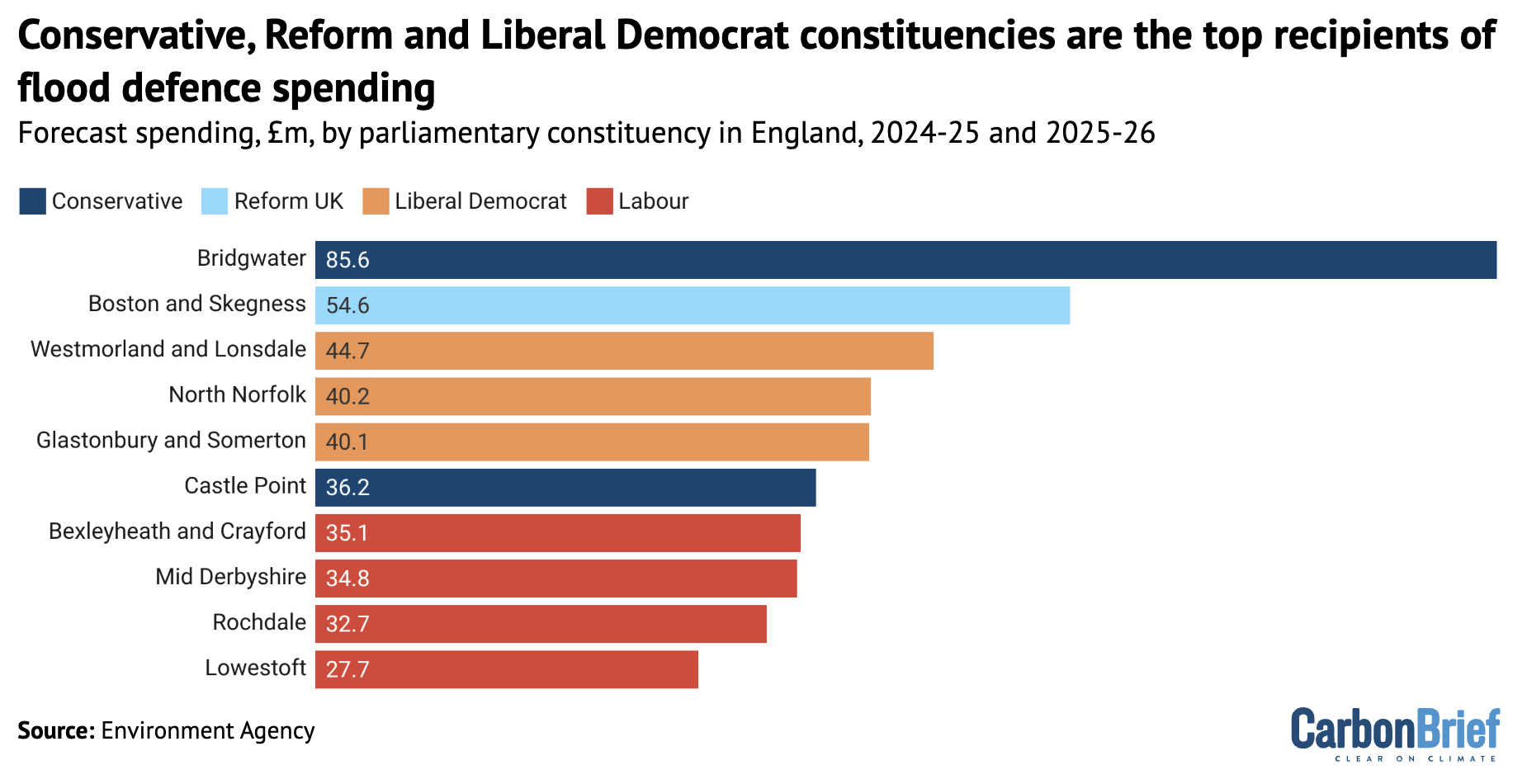

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

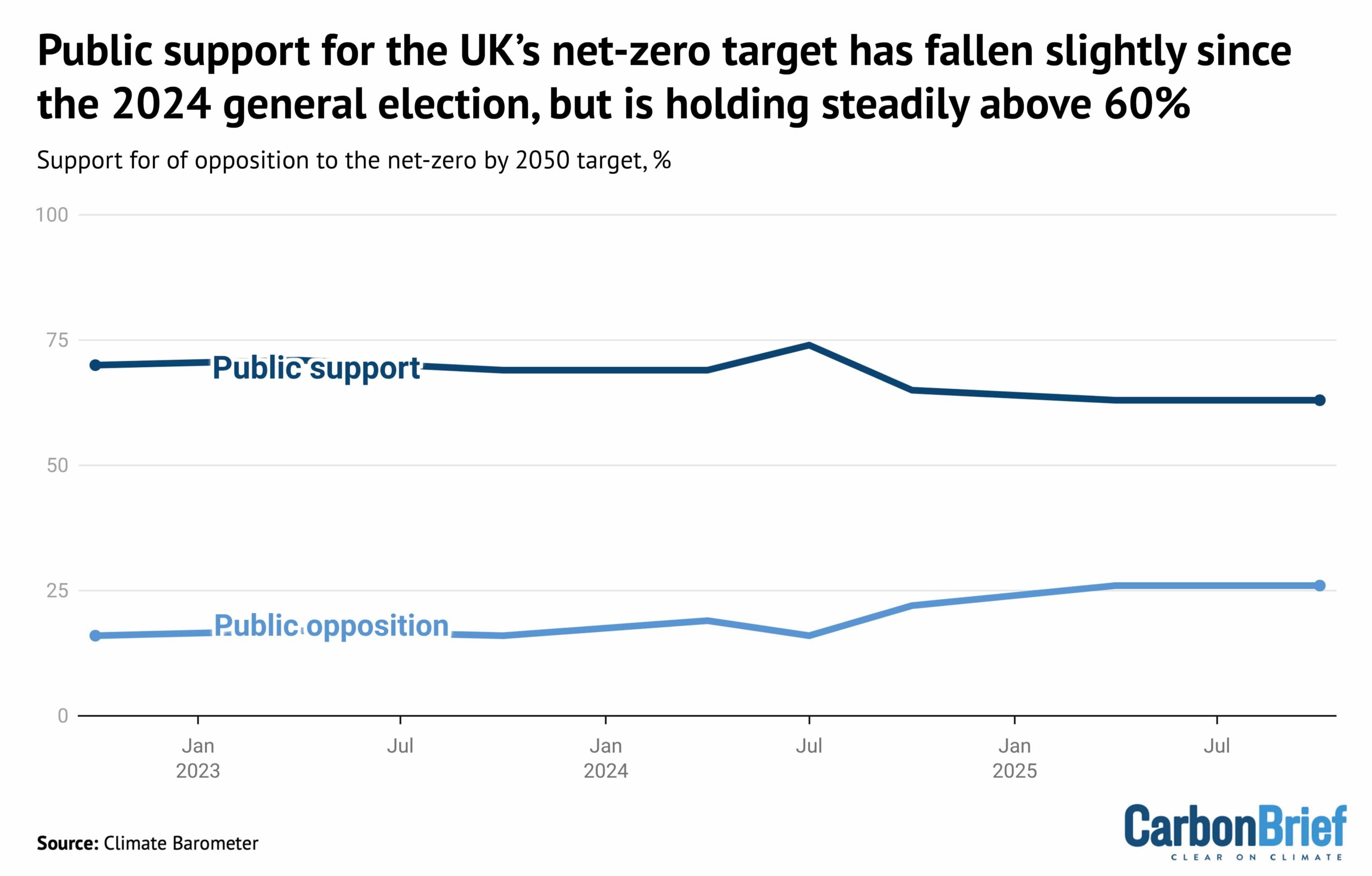

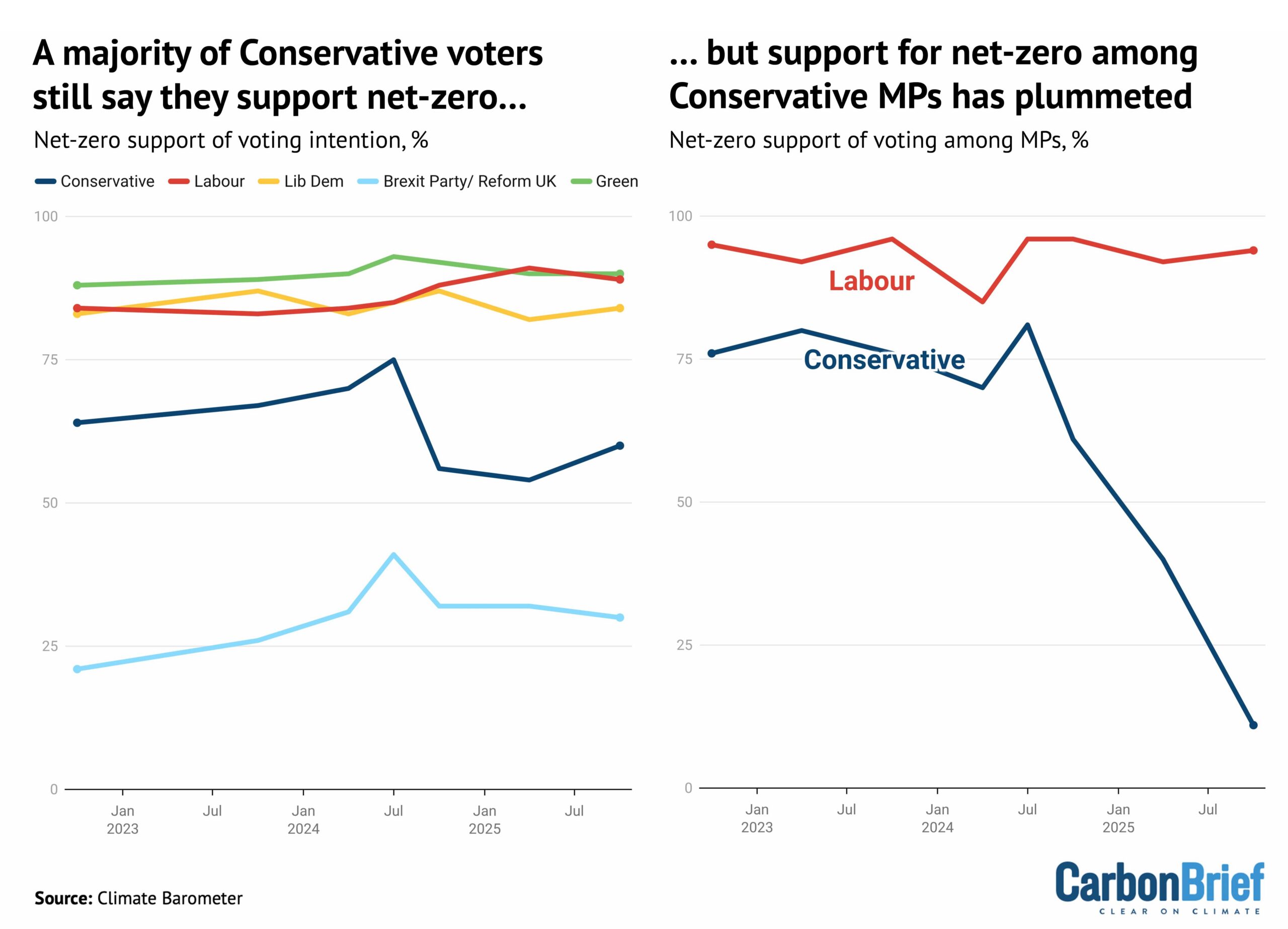

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Greenhouse Gases

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

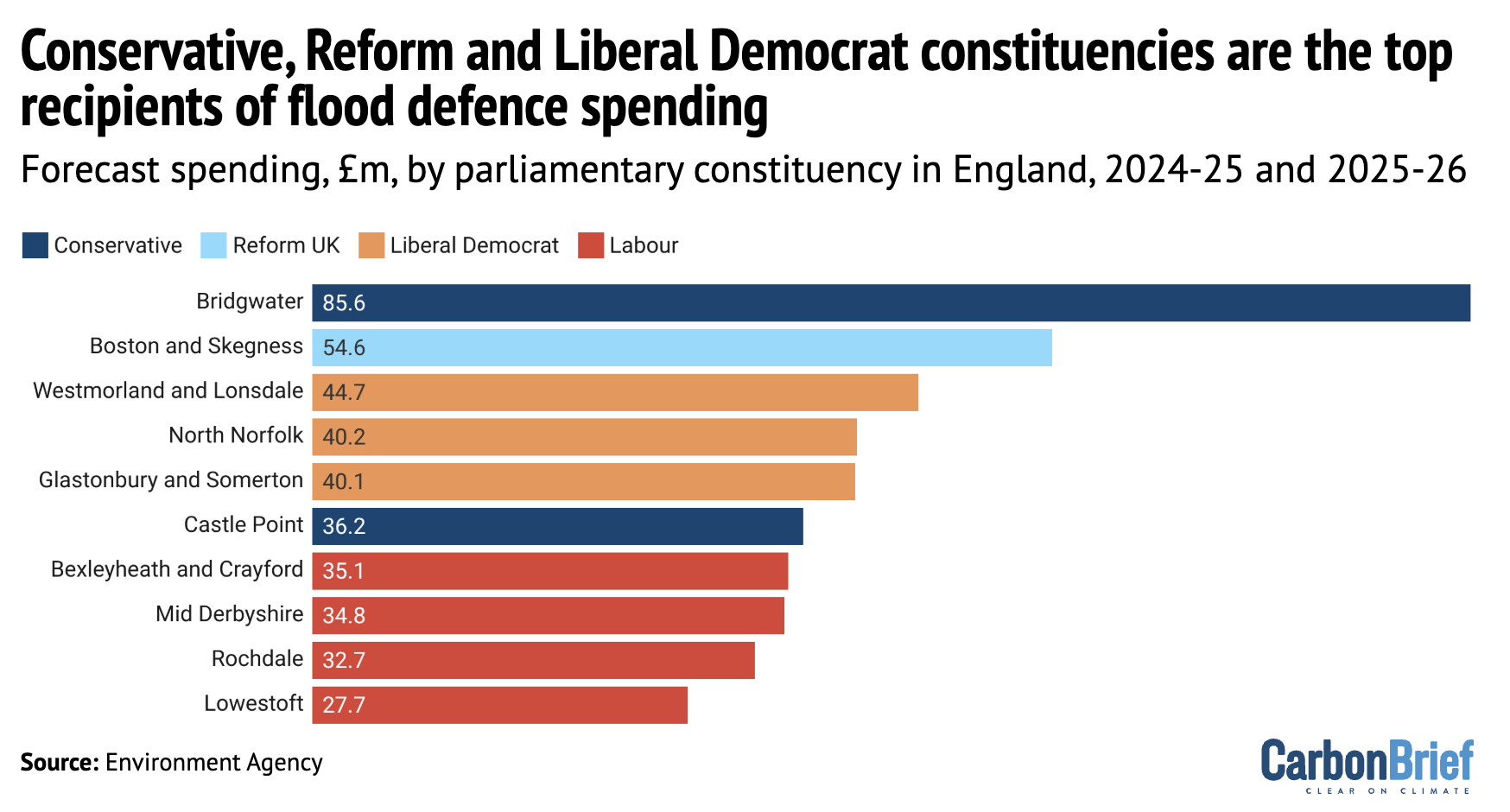

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

Greenhouse Gases

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

We handpick and explain the most important stories at the intersection of climate, land, food and nature over the past fortnight.

This is an online version of Carbon Brief’s fortnightly Cropped email newsletter.

Subscribe for free here.

Key developments

Food inflation on the rise

DELUGE STRIKES FOOD: Extreme rainfall and flooding across the Mediterranean and north Africa has “battered the winter growing regions that feed Europe…threatening food price rises”, reported the Financial Times. Western France has “endured more than 36 days of continuous rain”, while farmers’ associations in Spain’s Andalusia estimate that “20% of all production has been lost”, it added. Policy expert David Barmes told the paper that the “latest storms were part of a wider pattern of climate shocks feeding into food price inflation”.

-

Sign up to Carbon Brief’s free “Cropped” email newsletter. A fortnightly digest of food, land and nature news and views. Sent to your inbox every other Wednesday.

NO BEEF: The UK’s beef farmers, meanwhile, “face a double blow” from climate change as “relentless rain forces them to keep cows indoors”, while last summer’s drought hit hay supplies, said another Financial Times article. At the same time, indoor growers in south England described a 60% increase in electricity standing charges as a “ticking timebomb” that could “force them to raise their prices or stop production, which will further fuel food price inflation”, wrote the Guardian.

‘TINDERBOX’ AND TARIFFS: A study, covered by the Guardian, warned that major extreme weather and other “shocks” could “spark social unrest and even food riots in the UK”. Experts cited “chronic” vulnerabilities, including climate change, low incomes, poor farming policy and “fragile” supply chains that have made the UK’s food system a “tinderbox”. A New York Times explainer noted that while trade could once guard against food supply shocks, barriers such as tariffs and export controls – which are being “increasingly” used by politicians – “can shut off that safety valve”.

El Niño looms

NEW ENSO INDEX: Researchers have developed a new index for calculating El Niño, the large-scale climate pattern that influences global weather and causes “billions in damages by bringing floods to some regions and drought to others”, reported CNN. It added that climate change is making it more difficult for scientists to observe El Niño patterns by warming up the entire ocean. The outlet said that with the new metric, “scientists can now see it earlier and our long-range weather forecasts will be improved for it.”

WARMING WARNING: Meanwhile, the US Climate Prediction Center announced that there is a 60% chance of the current La Niña conditions shifting towards a neutral state over the next few months, with an El Niño likely to follow in late spring, according to Reuters. The Vibes, a Malaysian news outlet, quoted a climate scientist saying: “If the El Niño does materialise, it could possibly push 2026 or 2027 as the warmest year on record, replacing 2024.”

CROP IMPACTS: Reuters noted that neutral conditions lead to “more stable weather and potentially better crop yields”. However, the newswire added, an El Niño state would mean “worsening drought conditions and issues for the next growing season” to Australia. El Niño also “typically brings a poor south-west monsoon to India, including droughts”, reported the Hindu’s Business Line. A 2024 guest post for Carbon Brief explained that El Niño is linked to crop failure in south-eastern Africa and south-east Asia.

News and views

- DAM-AG-ES: Several South Korean farmers filed a lawsuit against the country’s state-owned utility company, “seek[ing] financial compensation for climate-related agricultural damages”, reported United Press International. Meanwhile, a national climate change assessment for the Philippines found that the country “lost up to $219bn in agricultural damages from typhoons, floods and droughts” over 2000-10, according to Eco-Business.

- SCORCHED GRASS: South Africa’s Western Cape province is experiencing “one of the worst droughts in living memory”, which is “scorching grass and killing livestock”, said Reuters. The newswire wrote: “In 2015, a drought almost dried up the taps in the city; farmers say this one has been even more brutal than a decade ago.”

- NOUVELLE VEG: New guidelines published under France’s national food, nutrition and climate strategy “urged” citizens to “limit” their meat consumption, reported Euronews. The delayed strategy comes a month after the US government “upended decades of recommendations by touting consumption of red meat and full-fat dairy”, it noted.

- COURTING DISASTER: India’s top green court accepted the findings of a committee that “found no flaws” in greenlighting the Great Nicobar project that “will lead to the felling of a million trees” and translocating corals, reported Mongabay. The court found “no good ground to interfere”, despite “threats to a globally unique biodiversity hotspot” and Indigenous tribes at risk of displacement by the project, wrote Frontline.

- FISH FALLING: A new study found that fish biomass is “falling by 7.2% from as little as 0.1C of warming per decade”, noted the Guardian. While experts also pointed to the role of overfishing in marine life loss, marine ecologist and study lead author Dr Shahar Chaikin told the outlet: “Our research proves exactly what that biological cost [of warming] looks like underwater.”

- TOO HOT FOR COFFEE: According to new analysis by Climate Central, countries where coffee beans are grown “are becoming too hot to cultivate them”, reported the Guardian. The world’s top five coffee-growing countries faced “57 additional days of coffee-harming heat” annually because of climate change, it added.

Spotlight

Nature talks inch forward

This week, Carbon Brief covers the latest round of negotiations under the UN Convention on Biological Diversity (CBD), which occurred in Rome over 16-19 February.

The penultimate set of biodiversity negotiations before October’s Conference of the Parties ended in Rome last week, leaving plenty of unfinished business.

The CBD’s subsidiary body on implementation (SBI) met in the Italian capital for four days to discuss a range of issues, including biodiversity finance and reviewing progress towards the nature targets agreed under the Kunming-Montreal Global Biodiversity Framework (GBF).

However, many of the major sticking points – particularly around finance – will have to wait until later this summer, leaving some observers worried about the capacity for delegates to get through a packed agenda at COP17.

The SBI, along with the subsidiary body on scientific, technical and technological advice (SBSTTA) will both meet in Nairobi, Kenya, later this summer for a final round of talks before COP17 kicks off in Yerevan, Armenia, on 19 October.

Money talks

Finance for nature has long been a sticking point at negotiations under the CBD.

Discussions on a new fund for biodiversity derailed biodiversity talks in Cali, Colombia, in autumn 2024, requiring resumed talks a few months later.

Despite this, finance was barely on the agenda at the SBI meetings in Rome. Delegates discussed three studies on the relationship between debt sustainability and implementation of nature plans, but the more substantive talks are set to take place at the next SBI meeting in Nairobi.

Several parties “highlighted concerns with the imbalance of work” on finance between these SBI talks and the next ones, reported Earth Negotiations Bulletin (ENB).

Lim Li Ching, senior researcher at Third World Network, noted that tensions around finance permeated every aspect of the talks. She told Carbon Brief:

“If you’re talking about the gender plan of action – if there’s little or no financial resources provided to actually put it into practice and implement it, then it’s [just] paper, right? Same with the reporting requirements and obligations.”

Monitoring and reporting

Closely linked to the issue of finance is the obligations of parties to report on their progress towards the goals and targets of the GBF.

Parties do so through the submission of national reports.

Several parties at the talks pointed to a lack of timely funding for driving delays in their reporting, according to ENB.

A note released by the CBD Secretariat in December said that no parties had submitted their national reports yet; by the time of the SBI meetings, only the EU had. It further noted that just 58 parties had submitted their national biodiversity plans, which were initially meant to be published by COP16, in October 2024.

Linda Krueger, director of biodiversity and infrastructure policy at the environmental not-for-profit Nature Conservancy, told Carbon Brief that despite the sparse submissions, parties are “very focused on the national report preparation”. She added:

“Everybody wants to be able to show that we’re on the path and that there still is a pathway to getting to 2030 that’s positive and largely in the right direction.”

Watch, read, listen

NET LOSS: Nigeria’s marine life is being “threatened” by “ghost gear” – nets and other fishing equipment discarded in the ocean – said Dialogue Earth.

COMEBACK CAUSALITY: A Vox long-read looked at whether Costa Rica’s “payments for ecosystem services” programme helped the country turn a corner on deforestation.

HOMEGROWN GOALS: A Straits Times podcast discussed whether import-dependent Singapore can afford to shelve its goal to produce 30% of its food locally by 2030.

‘RUSTING’ RIVERS: The Financial Times took a closer look at a “strange new force blighting the [Arctic] landscape”: rivers turning rust-orange due to global warming.

New science

- Lakes in the Congo Basin’s peatlands are releasing carbon that is thousands of years old | Nature Geoscience

- Natural non-forest ecosystems – such as grasslands and marshlands – were converted for agriculture at four times the rate of land with tree cover between 2005 and 2020 | Proceedings of the National Academy of Sciences

- Around one-quarter of global tree-cover loss over 2001-22 was driven by cropland expansion, pastures and forest plantations for commodity production | Nature Food

In the diary

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean | Brasília

- 5 March: Nepal general elections

- 9-20 March: First part of the thirty-first session of the International Seabed Authority (ISA) | Kingston, Jamaica

Cropped is researched and written by Dr Giuliana Viglione, Aruna Chandrasekhar, Daisy Dunne, Orla Dwyer and Yanine Quiroz.

Please send tips and feedback to cropped@carbonbrief.org

The post Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate appeared first on Carbon Brief.

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits