We’re surrounded by the words of human history’s greatest minds, many of whom seem to be reminding us of the jeopardy in which we find ourselves today.

We’re surrounded by the words of human history’s greatest minds, many of whom seem to be reminding us of the jeopardy in which we find ourselves today.

After the president the United States who was elected in 2016 lost in 2020, he went on a mission to retain power, and in the most blatantly illegal means imaginable.

Renewable Energy

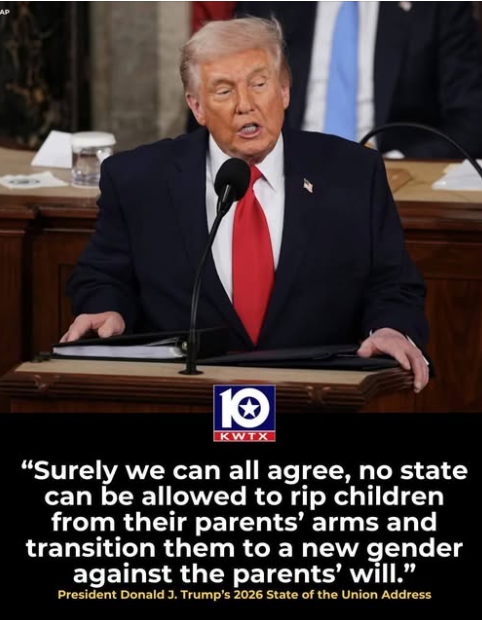

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

Renewable Energy

Cancelling Renewable Energy

This will result in lung disease, climate change, loss of biodiversity, and higher electricity prices.

This will result in lung disease, climate change, loss of biodiversity, and higher electricity prices.

It will also further alienate the rest of the world from our country, as every other nation on the planet is making gains in the direction of decarbonization, and no other nation suffers from this level of corruption with the fossil fuel industry.

If that pleases you, you’re a warped human being.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits