Weather Guard Lightning Tech

Masdar Acquires Stake in Terra-Gen, RWE Stock Price Drops, Maersk and Edison Chouest Partner in Offshore Installs

Masdar acquires stake in Terra-Gen, RWE’s stock price drops 25%, Global Wind Service signs agreement with RWE, and Maersk Supply Service partners with Edison Chouest Offshore for U.S. offshore wind farm installations.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Allen Hall: I’m Allen Hall, president of Weather Guard Lightning Tech, and I’m here with the founder and CEO of IntelStor, Phil Totaro, and the chief commercial officer of Weather Guard, Joel Saxum. And this is your News Flash. News Flash is brought to you by our friends at IntelStor. If you need actionable information about renewable projects or technologies, check out IntelStor at intelstor.com.

Masdar has signed an agreement to acquire a 50 percent stake in Terra-Gen power holdings from Energy Capital Partners, who will exit its position. Terra-Gen operates approximately 2. 4 gigawatts of wind and solar and 5. 1 gigawatts of energy storage facilities across 32 countries. U. S. sites, mainly in California and Texas, the transaction is expected to close by the end of 2024, while Igneo infrastructure partners will retain its existing 50 percent stake in the company.

So Phil, this is crazy because Mazdar is making big plays in Europe and now the United States. This is an impressive investment.

Philip Totaro: Yeah. And we’ve talked in recent episodes about the fact that Masdar has been making moves back at COP 28, they had publicly announced they were going to spend something like a hundred billion dollars in the next, five or 10 years or something on projects.

And I think it was like 42 different countries. This one’s interesting because of the energy storage play. Energy storage not only has huge growth prospects in the United States, but a company that is as financially focused as Mazdar is. They want to get in on energy storage projects because it gives them the opportunity to do hedging and energy trading.

This is exploding globally. And certainly, if you’re in ERCOT and you’ve got energy storage, you are making bank right now. And California as well. There’s all kinds of markets where, you know, especially if you can time shift power delivery away from negative pricing, which, again, you see sometimes in ERCOT or in CAISO.

This is this is a big opportunity for them. So I like this deal.

Allen Hall: New article from Reuters discussing the valuation of RWE, and if you’ve been following RWE lately, it has dropped 25 percent this year, its stock price has as it tries to transition to more renewable power generation. CEO Markus Krebber faces three main challenges, according to the article, depressed electricity prices due to low gas prices, falling green, Valuations due to rising interest rates and the company’s legacy assets in coal.

And if you, and Joel if, We, I’ve been watching RWE the last several weeks, even though they’re making massive investments in renewable energy, they don’t seem to be getting any credit for it from the stock market.

Joel Saxum: Yeah, it’s interesting because we talk about RWE doing big things all the time, right?

They’re always making some moves. I’m over here, Bilbao, they had a big sign on their side of their booth, 65 gigawatts of clean generation by 2030 is a goal. That’s massive, right? That’s, those are huge numbers, 65 gigawatts. So to me, when you actually, you brought this up and said, yeah, actually RWE stock price is not doing that well.

That was very surprising to me. I don’t see why they’re not getting the love from the markets, to be honest with you. And so if you are looking at some of these commodity prices just depressing that overall market, then I wouldn’t think you would see RW stock falling. Without all of the other operators doing the exact same thing.

Philip Totaro: Yeah. Although their exposure to coal is still obviously problematic and that is probably the biggest drain at the moment. I think the reason that they also don’t get as much credit for renewables projects is because of the. Limited amount of profitability that we’ve seen even for independent power producers in the market.

We’ve seen prices come back up in the past two, three years. Equipment prices power generation and equipment prices wind turbines, solar panels, et cetera. And so as a result you’re seeing thinner margins. From the independent power producers, more of that available margin, assuming that electricity prices that are charged to end consumers aren’t rising all that much.

You’re seeing, more margin being taken away from the independent power producers and being given to some of the OEM companies.

Joel Saxum: The big numbers here to look at is some of the things they’re stating in this Article is a company reducing its CO2 emissions by 27 percent in fiscal year 2023 and increasing its overall renewable electricity production by 27%.

So they are, while they do have the legacy coal issues, they are moving strongly in the direction of a more renewable portfolio.

Allen Hall: Global Wind Service has announced a three year agreement with RWE to support the company’s new offshore efforts in the UK in German waters. As part of this agreement, RWE is changing its strategy from a site by site servicing model to a fleet wide servicing model.

Now, Phil, you start to see this more and more in Europe and the United States is transitioning this way when an operator hires a company to do maintenance, it is becoming more of an area or a fleet wide contracts than the one off farm by farm approach.

Philip Totaro: Yeah, absolutely, and the fact that it’s being done more frequently with independent service providers is also noteworthy because normally, especially in Europe, an OEM gets a long term service contract even on, on offshore, but RWE’s got some of the most experienced people in terms of services and operations they know how to, run their project sites.

They do want somebody like global wind service though, to be able to come in and handle things at scale. And so that’s clearly what was driving that that deal.

Joel Saxum: It’s a win, right? So right now we know it’s hard to get good technicians. So this gives global wind service, the ability to get technicians.

No, they have backlog for them. No, they have work coming up. If they’re not working specifically on this one wind farm as a capital improvement project, whatever it may be. They’ve got work on all these other wind farms going on. So from a manning perspective, it makes absolute sense for RWE and for global wind service.

The other side of it too is vessel use, right? So if you can optimize one thing out there offshore, it’s the time that you spend in the vessel and what it’s used for. So if you spend, if you’re just going farm to shore, one, one wind farm to shore, one wind farm to shore, that’s not an efficient use of the time and money with vessel.

Now you’re bouncing around from wind farm to wind farm, staying out there on SOVs. So you’re a little bit more efficient there as well. And not only are you building that core group of technicians and having them out there and available, but you’re doing it in a more efficient way.

Allen Hall: Maersk Supply Service has partnered with Edison Chouest Offshore to accelerate the installation of offshore wind farms in the U. S. The partnership involves the construction of a purpose built wind farm feeder spread, including two tugs and two barges, to be delivered in 2026. The new feeder spread will transport wind turbine components or foundations to the installation site, potentially increasing installation efficiency by almost 30 percent.

The partnership aims to increase logistical access to more U. S. ports and reduce installation time for the wind farms. Joel, Edison Chouest obviously a big player in the United States and Maersk, a world player in shipping. This seems like a match made in heaven.

Joel Saxum: Yeah, Edison Chouest has a ton of experience.

The Gulf of Mexico, all oil and gas things, Edison Chouest vessels are out there all the time. They’re beautiful. They’re beautiful. Blue and white. They’re always out working. So you would expect, I actually expected to be honest with the America to enter this market earlier. As we saw as VAC to come in, partner up with Crowley, like that was a good tie up as well.

So I thought Maersk would jump in earlier, but the Edison Chouest is the perfect group for them. Edison Chouest as well. Right now they’re actually building a brand new SOV. I believe for Orsted at this time in their, one of their Louisiana shipyards as well. So they’re doing quite a lot.

Philip Totaro: The good news about this, is that it’s providing the U. S. more Jones Act compliant vessels, which obviously we need in order to accelerate the market. The challenge is that. With the pace that the government state or federal wants to get projects going now we’re still not going to have enough vessels to be able to handle the capacity that we’re going to need.

So again, this is a great step in the right direction. But we need to move a lot faster on, U. S. domesticated vessels if we really want to fully capitalize on the U. S. offshore wind market.

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

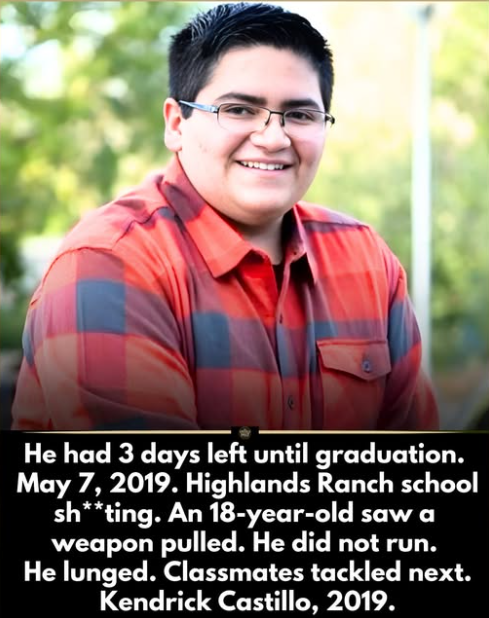

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

Renewable Energy

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

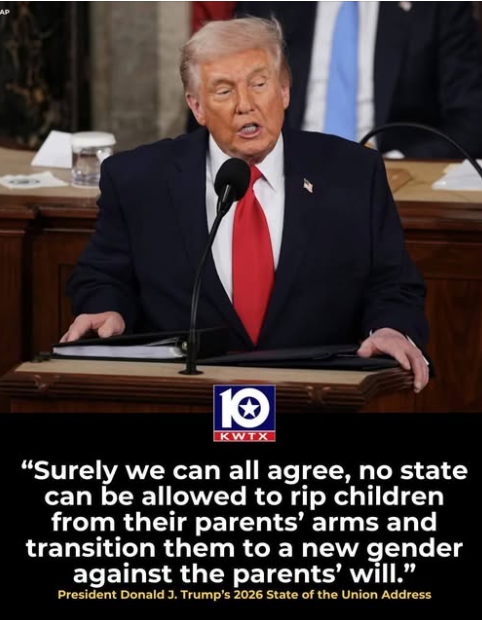

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits