Steve Capanna is policy director and Owen Zinaman is senior advisor for Crux Alliance.

Just a few years ago, green hydrogen looked set to become a central pillar of the global energy transition. Governments across the world rolled out sweeping hydrogen strategies, while companies pitched billion-dollar projects to use clean hydrogen throughout the economy.

But the realities of green hydrogen costs, exacerbated by high interest rates and supply chain constraints, have undermined these plans.

Meanwhile, the US – which had among the most ambitious suites of hydrogen policies under the Biden Administration – has reversed course, scaling back its clean hydrogen production incentive, freezing funds for green hydrogen hubs, and cutting the vast majority of federal hydrogen research and development funding. As a result, a number of planned projects have now been canceled.

Clean hydrogen is experiencing growing pains elsewhere too, with several major production projects in Australia and Europe scrapped or indefinitely postponed. Demand for green hydrogen is increasingly uncertain as well, with manufacturers like steel giant ArcelorMittal backing away from plans to use green hydrogen.

Some ‘no-regrets’ uses remain

Reading the headlines, it can seem like hydrogen has no future as a climate solution.

And yet, while green hydrogen may not be an emissions panacea, climate and energy experts are clear: it remains a crucial tool to cut carbon in some key areas of the economy.

“It’s critical to not throw the baby out with the bathwater,” says Nikita Pavlenko, programs director for fuels and aviation at the International Council on Clean Transportation. “Now is the time for sober consideration of projects that supply the no-regrets uses of hydrogen necessary for long-term decarbonization, whether for the handful of industries with few alternatives or in long-haul shipping and aviation.”

And for those countries that invest in green hydrogen development now, there could be economic as well as environmental rewards.

Not all hydrogen is created equal

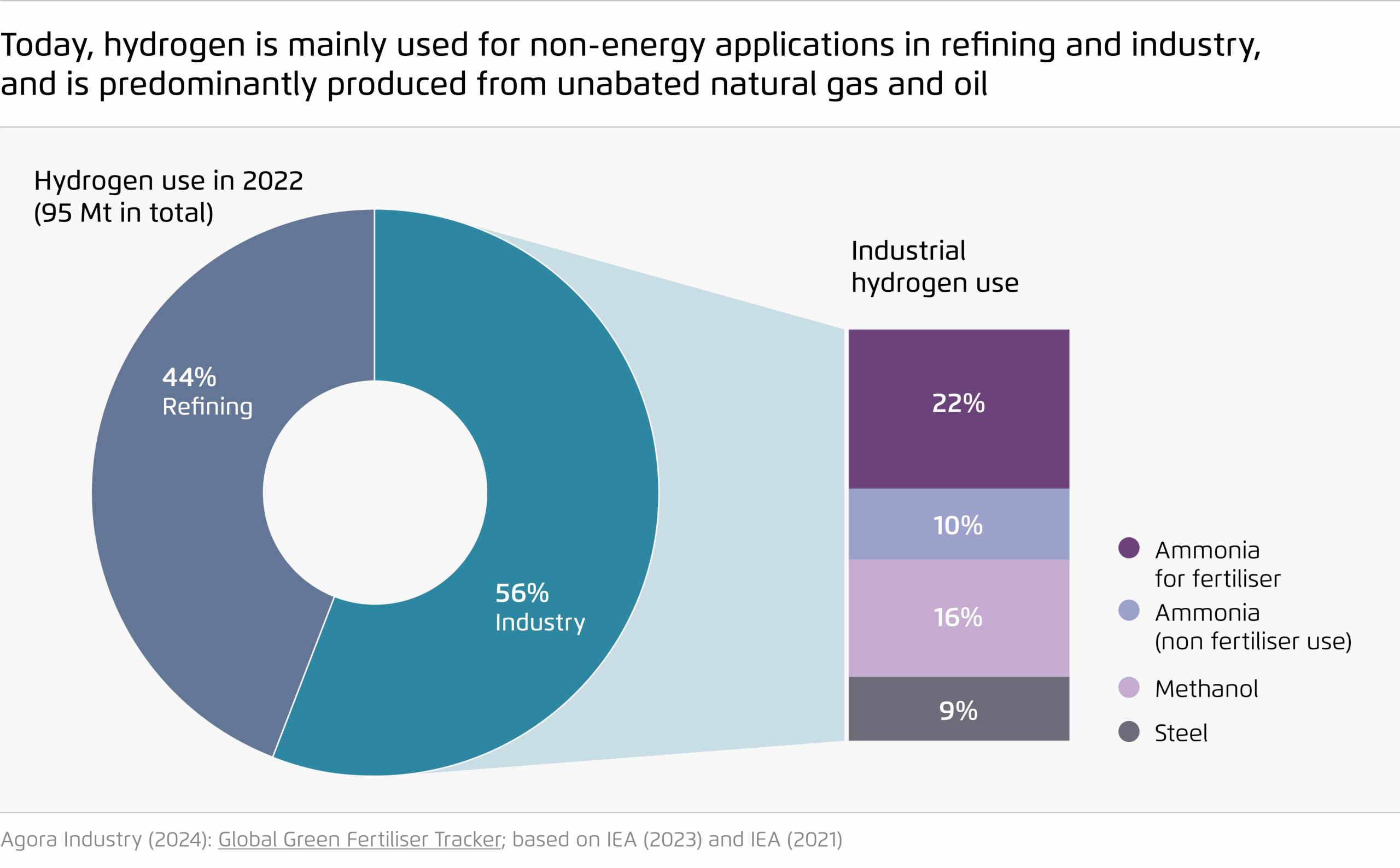

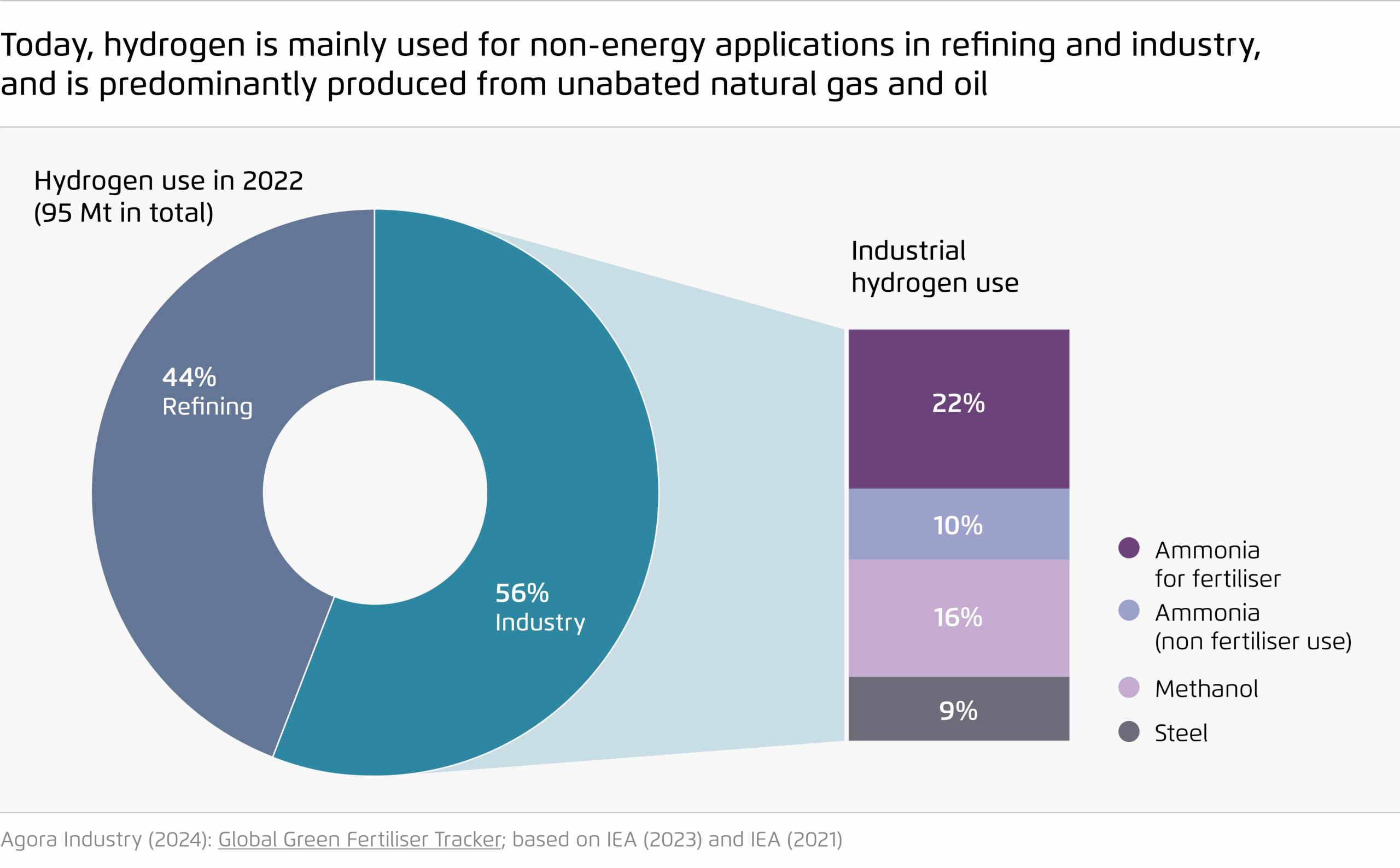

Hydrogen currently plays a niche but important role in the global economy. Nearly 100 million metric tons of hydrogen are produced worldwide each year, largely for use in oil refining and to make ammonia and methanol – feedstocks for fertilizers and industrial chemicals. And most of this hydrogen is produced using methane gas, contributing roughly 2% of global greenhouse gas emissions.

But there are other, cleaner ways to produce hydrogen.

“Blue” hydrogen still relies on natural gas but includes equipment to capture some of the carbon emissions released at the production facility. This could significantly lower on-site emissions – although not entirely.

However, it would do nothing to reduce methane and CO2 leaks from natural gas fields or pipelines, which an established body of evidence suggests have been systematically underestimated and are often not accounted for in many existing regulations anyway. Put together, this means blue hydrogen is likely much more polluting than is often claimed.

That’s why clean energy experts view “green” hydrogen as the best option for cutting emissions.

Green hydrogen is produced via a process called electrolysis, in which electricity is used to split hydrogen from water, leaving only oxygen as a byproduct. This process can be emissions free – but only if the electrolysis is powered by new clean electricity resources that are physically deliverable on an hourly basis to the hydrogen production facility.

A narrow but necessary path for green hydrogen

Still, scaling green hydrogen is easier said than done. Green hydrogen remains a nascent technology and costs roughly two to three times more than conventional hydrogen produced from natural gas. Costs are expected to decline as production scales, but only if electricity costs and interest rates are kept in check – which, recently, has not been the case.

But there is good news: experts argue that green hydrogen will only be needed in a few specific parts of the economy.

“Given the heavy energy losses in making hydrogen, it will almost always be cheaper and smarter to use electricity directly,” says Katherine Dixon, executive director of the Regulatory Assistance Project (RAP). “Heat pumps are the best example: they cut energy demand dramatically compared to gas, while hydrogen for heating would multiply it.”

And as other technologies get cheaper, the number of applications where green hydrogen is a necessary decarbonization tool will only shrink.

‘Hard-to-abate’ sectors need hydrogen

Still, in a net-zero economy, absent unforeseen technology innovations, we are going to need a lot more green hydrogen in the future – roughly four to six times more than all of the hydrogen used today, and many orders of magnitude more than current green hydrogen production.

Why? Because there remain many non-electrifiable sectors of the economy where no other viable decarbonization tool exists besides hydrogen, such as steel production, where hydrogen serves as a clean alternative to coal-based coke for processing iron ore.

“Green hydrogen will be critical for decarbonizing applications that have thus far been referred to as ‘hard-to-abate’, such as in the chemicals or steel industries,” says Julia Metz, director of Agora Industry.

Additionally, experts don’t yet foresee a path for battery technology to work for long-distance shipping or long-haul flights, both highly polluting industries, so green hydrogen and fuels made from green hydrogen will likely be necessary for those uses too.

Boosting demand to support long-term investment

Given the cost premium of green hydrogen, strong incentives will be needed to make using it in industry, aviation or shipping an economically viable choice while driving down costs for the future.

To date, countries have largely focused on policies like tax credits that encourage production of clean hydrogen or government investments in green hydrogen production and equipment manufacturing facilities.

EU backs North Africa hydrogen pipeline, but is it a green dream?

But scaling hydrogen requires demand-side policies as well. Indeed, we’re seeing planned projects and investments stall for lack of committed buyers. Stable demand-side policies, which can include contracts for differences (government financing for the higher cost of green hydrogen), requirements for a set percentage of hydrogen consumption to be green for certain sectors, and sectoral emissions limits, can help provide that long-term investment certainty.

Absent such policies, new clean hydrogen production projects have largely proven too risky.

How green is green enough?

Policymakers must also ensure they are only incentivizing truly clean hydrogen. Hydrogen produced with electricity largely generated by coal, for instance, can be considerably dirtier than conventional hydrogen production.

How to measure hydrogen emissions has been the source of robust debate in the European Union (EU), US, and elsewhere. Fossil fuel companies have argued for more lenient standards about what counts as clean. They have also supported using hydrogen in parts of the economy that could be more easily and cheaply electrified, distracting from efforts to electrify quickly.

For a region like the EU, which is poised to be an importer as well as a producer of green hydrogen, stricter standards can help ensure truly low-carbon hydrogen production around the world.

China, for instance, has developed its clean hydrogen production with an eye towards meeting the EU standards. China is also placing major bets on the green hydrogen market, as it represents roughly 60% of global electrolyzer production.

This investment is beginning to drive down equipment costs, which could help make green hydrogen more commercially viable. It could also give China a long-term competitive edge in the global market.

Smart policies create economic opportunity

However, other countries with abundant, low-cost renewable energy resources are also recognizing the potential of green hydrogen as both an export opportunity and a way to reduce reliance on volatile natural gas imports.

For instance, India’s Green Hydrogen Mission targets the production of 5 million tonnes of green hydrogen by 2030, and Brazil has an official goal to be the most competitive low-carbon hydrogen producer by that same year.

To fully capture the economic opportunity, new hydrogen producers will need to ensure their output meets international environmental standards while building up those domestic industries that require green hydrogen to cut emissions, ensuring more economic benefits are realized domestically.

“Governments play a key role in driving innovation that creates economic opportunities across the value chain,” says Metz of Agora Industry. “By supporting green hydrogen investment and adopting targeted industrial policies, they can strengthen resilience while advancing climate and industrial progress.”

It’s time for hydrogen sobriety

The hydrogen bubble has burst. But despite the dire headlines, we cannot achieve global climate goals without some amount of truly clean hydrogen.

If the last few years were dominated by hydrogen hype, we need the future to be dominated neither by hype nor nihilism, but by a sober focus on designing policy to build demand for green hydrogen in the few, important sectors where it’s really needed.

Let’s hope the era of hydrogen sobriety has finally arrived.

The post Hydrogen beyond the hype: The green fuel’s narrow but crucial role in a decarbonized economy appeared first on Climate Home News.

Hydrogen beyond the hype: The green fuel’s narrow but crucial role in a decarbonized economy

Climate Change

Facing Its Third Data Center, an Iowa County Rolls Out Extensive Zoning Rules

Linn County has adopted some of the nation’s strictest data center zoning rules. Residents say the protections aren’t enough.

PALO, Iowa—There are two restaurants in Palo, not counting the chicken wings and pizza sold at the only gas station in town.

Facing Its Third Data Center, an Iowa County Rolls Out Extensive Zoning Rules

Climate Change

Are ‘Climate Hushers’ Lurking in the Democratic Party?

A push to emphasize affordability isn’t climate hushing, its advocates say. But a Democratic think tank has suggested this recalibration is in order—and some in the party are tweaking their messaging.

In late January, U.S. Sen. Sheldon Whitehouse of Rhode Island, a long-time climate hawk, said in a thread on X that Democrats should ignore calls to stop talking about climate.

Climate Change

Helping Trees—and a City—Outrace Climate Change

Arborists and land managers are trying “assisted migration” as global warming threatens livability in communities and the health of urban and rural forests.

LOUISVILLE, Ky.—Nearly a foot of snow has melted. The deep freeze that sent temperatures across the region plummeting to below zero has warmed to a balmy 55 degrees on a sunny February day.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits